Best Insurance Companies For Drivers With Accidents – Best car insurance for good drivers of 2025 (top 10 companies) has the best car insurance for good drivers for Mica Mutual, Progressive and Geico Good drivers. Young drivers with no accident can find fewer Geico rates at $ 43 per month. Progressive has the biggest discount of driver at 30% for good drivers. Compare our primary companies to find the best car insurance for good drivers.

Rachel Bodin graduated from a college lage with a single English. Since then he has been working as a partner’s insurance industry and has received the insurance law and insurance rate Deep Vanda J Knowledge. Their research and writing focuses on helping readers understand how to find their safe insurance and collection. Its expert insurance advice is shown on sites like PhotoNforced, all … …

Best Insurance Companies For Drivers With Accidents

Daniel VKer graduated from BS to Administration Management in 2005 and run his family insurance agency, FCI agency, over 15 years (BBB A +). He has been licensed as an insurance agent for writing property and accident insurance, including home, life, umbrella insurance. It also shows sites like reviews.com and safe. To ensure our content is acuka …

Best Car Insurance After An Accident In Massachusetts (top 10 Companies For 2025)

Advertising Apocalypse: We are trying to help you rely on car insurance decisions. Compare purchases should be easy. We are not associated with any Auto toe insurance provider and cannot guarantee the quotes of any provider. Our collaboration does not influence our content. Our opinions are our own. To compare quotes from many different companies, please enter your pin code on this page to use the free quotes tool. The more you compare the quotes, the more opportunity to save.

Editorial Instructions: We are a free resource Naline resource for anyone who is interested in knowing more about automatic insurance. Our goal is a goal, third -party resource related to all auto insurance. We always update our site, and all content is checked by car insurance experts.

Mica Mutual, Progressive and Geico has the best car insurance for good drivers as they provide liberal car insurance discounts and solid UBI programs.

While many companies offer many car insurance discounts for good drivers, Mica has taken our highest position for better customer service, coverage options and coverage payments.

Best Cheap Car Insurance Rates In Texas (as Low As $33/mo)

Check your options for the best car insurance for good drivers below. After that, compare rates to find the cheapest scope by entering your zip code on your free comparative tool.

There are several reasons affecting the car insurance rate, but the most important is your driving record. The wrong accident on your record can increase your rates according to the table below.

As you see, rates vary with accident or traffic violation. Understanding the history of your claims can help you find a cheap scope, which you can learn how to check your car insurance.

If you have points on your driving record, the rates increase, however, you will not pay for a permanent price. Most accidents and traffic violations come to your record after one year or more depending on your residence. Brandon Freddy License Received Insurance Manufacturer

Best Car Insurance In Malaysia 2025

Your drive record is still one of the reasons why it is important to compare quotes with many companies. Insurance companies use different decisions to determine how much payment is for coverage.

Even though they all want to see for a single reason, companies keep the weight of every reason. Comparing the quotes of different companies is the only way to ensure that you have taken the lowest rates for your unique circumstances.

In addition, having a clean driving record helps reduce your car insurance rate. According to the driver’s insurance program and the redressal programs of complaints, you can get the exemption for a safe driver.

Many people think that insurance for drivers offers cheaper rates, and they get the best car insurance with a car driving deal with driver’s deal.

Cheap Car Insurance For 18-year-olds

Your driving record has a big role in how much you pay for automatic insurance. Companies like Safe Auto toe and Mica see your history to find your rate. If you have a clean driving record, you can pay less. Some insurance groups offer discounts through programs like good driver driving for safe drivers.

However, if you have an accident or violation, you can consider a driver marked for automatic insurance, which can increase your rate. If you are a safe driver, you can qualify for the best car insurance score, giving a better scope at a lower price.

On the other hand, if you are looking for the best car insurance for bad drivers, your premium may be higher. Programs like Next Driver in Florida help reduce the rate for safe drivers, and some companies offer driving records, but these options can have less benefits.

Auto Insurance is “good driver-friendly” if it offers discounts and better scope for safe drivers. Companies that provide the best car insurance, usually reduce your rates if there is a clean driving record.

Hit By Uninsured Driver

Programs like the captured Texas Program rewards drivers who comply with the rules of traffic with better rates. Some Auto toe insurance providers do not check the driving records, allowing drivers with less full historical hist history still allows to gain scope. If you are a responsible driver, you can find the best car insurance for good drivers, offer the lowest premium and additional features.

Critical driver’s insurance program with the possibility of cheap with good driving records. Insurance coverage with the full driver’s program often includes a wide and collision with cheaper prices.

You can also see the social program of a complex driver’s program to compare different options. In the end, the goal is to find the best car insurance to reward safe driving.

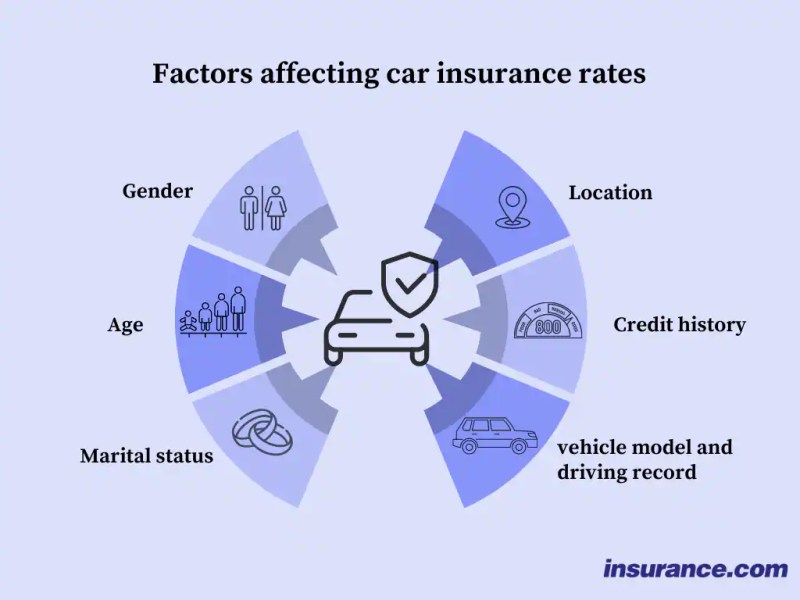

Good drivers sometimes pay less for car insurance. However many things affect your payment for your policy. Knowing these factors can help you find a better deal and the right scope.

How Much Does Your Insurance Go Up After An Accident?

Considering these reasons, you will get the best insurance to reward your good driving and help reduce your premium.

Discount is a great place to protect safe drivers their insurance, but this is not that moment. You can also sign up for a usage-based (UBI) program.

UBI programs use tracking devices to monitor your driving behavior, such as acceleration, hard work, and the time of the day you drive. The better you drive, the more frequent saves. For example, you can save up to 40% with the stimulation of ST Lustat. You will find more about how to store with the ST Lustat’s UBI program in our ST Lustat Drivies review.

However, UBI programs are changed by the company. Check below to see the maximum UBI discount offered by some primary insurance companies.

Auto Insurance Guide

Signing up for the UBI program is a great way to save your insurance, but you need to make sure that it is worth it before you sign up. You only get a discount by practicing safe driving habits, and in some cases, you can see your rates if you are not safe.

While it is always helpful to know what a good car or trick score is to prevent your rates, there are some crazy prices to reduce your claim. If you need to lower your rates, try the following:

Of course, clearing your drive records is another easy way to keep your rates. See how car insurance companies check out driving records here to see how your rates affect.

If you try to find out how to get a good dispute Auto toe insurance discount, you may be amazed at your preferences. Most companies offer more than a safe driver’s discount – check below to explore your preferences.

Progressive Auto Insurance Review & Best Alternatives

There are many options for safe drivers, though not every discount available for each company. Be sure to check a representative or read the reviews of the above company to see what discounts are available.

In addition, a safe discount on driver Auto toe Insurance helps you save money. If you are interested in this discount, you can see the best programs of the program’s insurance program, showing programs to reward safe driving.

Auto toe insurance for the driver’s compliance program offers discounts for drivers complying with the rules, which makes it the best choice. The driver’s driver’s insurance cost may change, but it is usually cheaper for people with clean driving records. For new drivers, the best insurance option helps lower rates.

Auto toe Insurance Discount is a great way to save money, with many companies that offer important storage for drivers with clean records. Joel Ohman Certified Financial Organizer

Lakewood Rideshare (uber/lyft) Accident Attorney

Safe drivers can get discounts, and the driver’s driver’s driver’s programs because the complex program offers cheap insurance for new drivers and low insurance rates for new drivers.

If you have a clean driving record, you can save many car insurance with a good driving discount by selecting the right company. Mica Mutual, Progressive and Geico Many Options, said that the eligible for discount offers many discounts and strong coverage.

Many safe drivers see insurance for primary drivers to find better rates. You can also check the driver’s driver’s driving program